- This event has passed.

Understanding TANF Cost Recovery in the Child Support Program

July 12, 2024 @ 12:00 pm

Many children and their custodial parents receive child support payments from non-custodial parents to help cover child-rearing costs.[2] Child support can be a significant source of family income for families struggling to make ends meet. That is especially true for families receiving cash payments from the Temporary Assistance for Needy Families (TANF) program, who receive benefits that still leave them at or below 60 percent of the federal poverty level in every state.[3]“Child support payments often do not reach families participating in TANF. And even after they leave TANF, states still keep some of their child support payments. “

However, child support payments often do not reach families participating in TANF. And even after they leave TANF, states still keep some of their child support payments. State child support policies typically prioritize reimbursing the state and federal government for TANF cash payments provided to families during times of need, rather than directing payments to the children for whom they are intended. States have policy options to direct more child support payments to families who receive or used to receive TANF assistance, but only half of states have chosen to exercise any of those options.

Families, not states, should receive the child support payments made by non-custodial parents for their children. The goal is to pay all child support to families who receive or previously received TANF — including both monthly support and past-due support. Federal law gives states the flexibility to achieve this goal by combining policy options that direct more child support payments to families and decrease payments kept by the state. States have two key decisions to consider regarding how they direct, or do not direct, child support to families. The first is whether to enact “pass-through” policies that ensure child support payments are directed to families. The second decision is whether to adopt family-first distribution of child support collected through the federal tax system, a state option known as “DRA distribution” under the Deficit Reduction Act of 2005 (DRA).

In this paper, we explain these terms and decision points, and discuss the history, rules, and mechanics of using child support to reimburse TANF cash assistance. We focus on families receiving TANF cash assistance and who formerly received TANF cash assistance and outline how the child support and TANF programs intersect and operate, with a focus on the cost recovery process.[4]

Through understanding the rules and mechanics related to TANF cost recovery in the child support program, policymakers, family advocates, and other stakeholders can explore the full range of policy opportunities and pursue policy changes at the state level that direct more child support to families. (A future paper will make the case for states to increase family resources, improve child and family well-being, and promote equity by paying all child support to families.)

Below, we discuss the following key child support payment rules and mechanics:

- The state’s legal claim to child support payments, or “assignment,” for families who receive or previously received TANF cash assistance;

- The order in which child support payments are “distributed,” or allocated, to the various parties with legal claims to child support (namely custodial families) and to the state under an assignment; and

- State options for directing collected child support to families and the differences between these options.

Receiving Child Support Is Critical to Family Well-Being

Among custodial families with incomes below the federal poverty level, child support represents, on average, 41 percent of their income when received. The share is even larger for custodial families living below 50 percent of the federal poverty level, with child support making up 65 percent of their income when received.[5]

More child support payments can help families cover essentials like rent, utilities, food, school supplies, and children’s clothing.[6] Regular child support payments can also promote financial stability by serving as a long-term stream of consistent cash income that custodial parents can rely on to meet their children’s needs.[7] Further, research shows that receiving child support payments can promote positive outcomes for children and families, including increased parental involvement among non-custodial parents and better child developmental outcomes.[8]

Families enter the child support program through two separate and unequal routes. One route is voluntary. Custodial parents, regardless of income, can choose to apply for child support services for a small fee in order to establish and enforce child support orders. Families entering the program this way keep child support payments collected on their behalf.

Through the other route, however, custodial families who receive TANF cash assistance are required to participate in the child support program as a condition of receiving cash assistance, regardless of whether they want child support services. This participation requirement is called “cooperation.”[9] Failure to cooperate with the child support program results in at least a 25 percent reduction in the amount of cash assistance provided to the family. In fact, some states do not provide any cash assistance at all to families if they fail to cooperate.[10]“Custodial families participating in TANF often do not receive any of the material or social benefits from child support payments. Instead, they are forced to relinquish their legal rights to child support income.”

Custodial families participating in TANF often do not receive any of the material or social benefits from child support payments. Instead, they are forced to relinquish their legal rights to child support income, which, if they received it, could help lessen their financial precarity. As a condition of receiving cash assistance, they are required to transfer their rights to child support payments to the state through a legal mechanism called “assignment.”[11] The child support collected on their behalf is then kept by the state and split with the federal government as repayment for TANF cash payments made to a family. This policy is known as “cost recovery.”[12] Cost recovery policies predate the child support program and are based on the idea that non-custodial parents should repay the state for public assistance their children receive.

In practice, this means that when a non-custodial parent pays child support for a child receiving TANF cash assistance, the money may be claimed by the state and treated as government revenues instead of being given to the custodial family. Even when a family no longer receives TANF cash assistance, the state may continue to keep some child support payments owed during the time the family received TANF benefits, typically when support is collected through a non-custodial parent’s federal tax refund. Child support payment distribution rules are explained in more detail in the following sections.

Cost recovery policies deprive struggling families of a vital source of income to make ends meet. These policies impact custodial families participating in TANF — households that are generally headed by women with low incomes, and, to a disproportionate extent, women of color. The unfairness of these policies can land particularly hard on Black women, who have worked hard to provide for themselves and their families — despite long-standing structural racism and sexism in the labor market that have severely limited their employment prospects and depressed their wages.[13]

Cost Recovery Policies Predate the Child Support Program

Congress established the federal child support program in 1975 under title IV-D of the Social Security Act to expand and improve child support enforcement laws and processes then available in states and to create the federal Office of Child Support Enforcement.[14] Title IV-D had two legislative purposes: to recover the costs of cash assistance under the Aid to Families with Dependent Children (AFDC) program — TANF’s predecessor — and to avoid the need for cash assistance by increasing custodial families’ child support income.

The child support program established through title IV-D has a complicated history. Women’s rights and anti-poverty advocates championed its creation. It was largely a response to rising divorce rates among white middle-class families, large income disparities between divorced men and women, and high poverty rates among predominantly white mothers who were previously considered to be middle class and who shouldered most child-rearing responsibilities and costs following divorce.[15] The legislative history of title IV-D also reflected concerns over the growing number of children born to unmarried parents, and the view that children have a right to know who their parents are, to establish parentage, and to receive child support. In a number of ways, title IV-D challenged traditional ideas about gender roles, marriage, and family structure more prominent at the time.

Yet the child support program also was established to recover cash assistance costs. The cost recovery policies incorporated into the TANF program are deeply rooted in what were named “bastardy” and “poor relief” laws, which reflected certain attitudes and assumptions about people experiencing poverty in the 19th century. One such assumption was that individuals are to blame for their circumstances and should be held personally responsible for them, rather than considering the many structural causes of poverty. Under this view, government assistance should be granted grudgingly — if at all. Most poor relief laws included definitions of who was legally entitled to public assistance. Notably, those entitled to relief usually had to be white and unable to work.[16]

Poor relief laws treated public assistance as a loan or debt that could be collected through a legal action brought by the county against the recipient, while bastardy laws, initially criminal in nature, required the mother of a child born outside of marriage to identify the father so the court could establish paternity and order support for the maintenance and education of the child.[17] Poor relief and criminal bastardy laws were also used to force both children and parents into indentured labor in exchange for public assistance. Some Southern states maintained these laws into the 20th century as a racialized system of social control targeting Black families that prevented them from earning wages for their labor and escaping poverty.[18]

Initially, child support services funded under title IV-D were only available to custodial families receiving AFDC. These families were required to participate in the child support program and to sign over their rights to child support to the state in exchange for receiving cash assistance.[19] In 1984, however, Congress required states to allow custodial parents to apply for child support services even if they did not receive AFDC.[20] At the same time, federal law retained the cooperation and assignment requirements for custodial families receiving AFDC.

The policies that guide cost recovery for current and former TANF recipients today reflect policies that were enacted through the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) — the law that created TANF — and the Deficit Reduction Act of 2005 (DRA), which also reauthorized and made significant changes to TANF. These laws narrowed TANF assignment policies, expanded the rules that prioritize payment of child support to families (known as “family-first distribution”), and increased state flexibility to direct more child support to TANF families.

More than 60 percent of all custodial parents in the U.S. now participate in the child support program.[21] About half of custodial parents participating in the program currently receive or previously received TANF cash assistance, while half never received cash assistance. Although federal child support services are available to all regardless of income, custodial parents with limited incomes are more likely to participate than custodial parents with higher incomes.[22] Most custodial parents participating in the child support program have family incomes at or below the federal poverty line.

Parents who hire private attorneys to represent them in a divorce proceeding or otherwise obtain child support orders are not part of the federal child support program unless they later apply for program services to enforce their orders. Non-custodial parents also may apply for child support services, for example, to legally establish their parentage or to adjust their support order.[23]

Establishing, Enforcing, and Collecting on Child Support Orders

The legal obligation of non-custodial parents to pay child support is created through the establishment of a child support order. Depending on the state, a court or administrative agency sets a monthly support obligation amount as part of a child support order calculated according to state child support guidelines. State guidelines require order amounts to be based on parental earnings, income, and other evidence of ability to pay.[24]

In all but a handful of states, child support orders account for the income of both parents. The amount of support payable every month is called “current support.” If a non-custodial parent falls behind in payments, the past due amount accrues as debt, often called “arrears.” Arrears may be owed to a family or the state depending upon whether the support was due during the TANF assistance period. More than 80 percent of program arrears are owed to families, while less than 20 percent are assigned and owed to states.[25]

Arrears owed to the state under an assignment are often referred to as “state debt.” In half of states, child support arrears, whether owed to the family or state, accrue government-imposed interest.[26] The state debt includes any added interest, fees, and costs.[27] States have full authority under federal law to reduce, forgive, or write off state debt, without owing a federal share, and most states have state debt-reduction programs or procedures.[28] However, only custodial parents can forgive arrears (including interest) owed to them.

Almost all income sources, as well as assets, are legally subject to child support enforcement, including wages, federal and state income tax refunds, unemployment insurance, worker’s compensation, Social Security benefits under title II of the Social Security Act, insurance settlements, and funds held in a bank account.[29] Most child support payments are collected on time through automatic payroll and other income withholding — a process similar to withholding income taxes.[30] Payroll withholding is required for all non-custodial parents who owe child support, whether or not the parent is behind on payments.[31]

When non-custodial parents fall behind on their payments, the child support agency can collect arrears through a variety of enforcement mechanisms, including garnishments, deducting or “offsetting” federal and state income tax refunds, bank account liens, credit bureau reporting, driver’s license suspension, and incarceration.[32] Child support payments are initially sent to a state payment processing center (sometimes called a state disbursement unit) for accounting and disbursement.[33]

States retain and allocate collections assigned by families participating in TANF based on state distribution and pass-through policies. In 2022, states and the federal government kept two-thirds of assigned collections made on behalf of children receiving TANF assistance to reimburse cash assistance costs, while the remaining third was paid to custodial families during the assistance period.

Amounts retained as assistance reimbursement are shared with the federal government according to a state’s Federal Medical Assistance Percentage (FMAP). FMAP rates are used to determine the amount of federal matching funds for state expenditures for Medicaid and certain other programs. They are calculated by the U.S. Department of Health and Human Services each year by comparing each state’s per capita income relative to U.S. per capita income. States with lower per capita incomes have higher FMAP rates, meaning the federal government contributes a higher share of matching funds for state Medicaid expenditures.[34] As a result, states with higher FMAPs must send back a larger share of child support collections to the federal treasury to reimburse the federal share of cash assistance costs.[35]

Understanding Child Support Assignments

Child support assignment and distribution policies address two questions. “Assignment” policies answer the question: “Does the state have a legal claim to the child support payment?” When the rights to support payments are assigned to the state, “distribution” policies answer the question: “Is the state’s or family’s claim to the payment paid first?”[36]

The TANF assignment requirement establishes the state’s legal claim to child support payments to reimburse the government for cash assistance payments made to the family.[37] In order to receive TANF cash assistance, custodial families must participate in the child support program and “assign,” or sign over to the state their rights to child support payments owed during the period they receive cash benefits from TANF.[38]

Without an assignment, the state does not have the right to keep child support payments. Support payments that become due before or after a family receives TANF are not assigned, and instead are owed to the family. However, support payments that become due during the assistance period are permanently assigned and remain owed to the state even after the family leaves TANF.

Before the DRA was enacted in 2006, families receiving TANF were required to assign the rights to support owed to them before an assistance period, as well as during the assistance period. This policy was called “pre-assistance” assignment.[39] This broad assignment requirement meant that states could keep considerably more support to reimburse assistance, while families ended up with less support.[40]

However, the DRA narrowed the scope of assignment to support owed during the assistance period and eliminated pre-assistance assignment. But the change in the law was prospective — it applies only to assignments entered into by October 1, 2009.[41] This means that the old pre-assistance assignments that families entered into before the implementation date are still legally valid. The DRA addresses this by giving states two options: one option allows states to cancel pre-assistance assignments entered into before that date. The other option allows states to cancel all assignments of any type entered into before October 1, 1997 (before PRWORA distribution rules were enacted).[42] When a state cancels old assignments, the state’s claims to the assigned child support payments are extinguished, and no federal share is owed.[43]

States may only keep the amount of support payments due under the child support order and assigned to the state. In addition, a state may only retain assigned support to reimburse TANF cash assistance — that is, assistance “paid to the family” in the form of “money payments in cash, checks, or warrants immediately redeemable at par.”[44] For example, the state may not keep child support to repay child care vouchers even when it is considered assistance from the state.

States keep a tab of the amount of cash assistance paid to a family, called the “Unreimbursed Assistance” (URA) balance, which establishes the maximum amount of reimbursement a state may seek. The URA balance accounts for all cash payments made to a family, but the state may only collect reimbursement for months in which a child support order is in place. Child support payments kept by the state reduces the URA balance dollar for dollar. The URA balance includes the cumulative amount of cash assistance paid during all assistance periods.[45]

In addition, states may not keep child support as reimbursement for TANF payments received before a child support order is in place or keep more than the amount due under the child support order. This is because the state only has a legal right to the amount of child support that has been assigned to it. The assignment law does not impose a general obligation on non-custodial parents to repay the entire amount of assistance paid to the custodial families. For example, if a custodial family receives $400 in cash assistance per month for ten months, the beginning URA balance is $4,000. However, if the child support order is not established until the fifth month and the non-custodial parent is ordered to pay $200 per month, the state may only keep the assigned child support amount of $1,000 (five months at $200 per month). In other words, the state’s right to keep child support payments is limited to the lesser of the URA balance or the cumulative support obligation.[46]

Understanding Child Support Distribution Policies

Child support “distribution” rules govern how state child support programs allocate child support collections between families and the state when a family is receiving or has received TANF cash assistance.[47] Distribution rules prioritize state or family claims to payment and establish the order in which multiple claims are paid.[48] Because support collections usually are not large enough to pay off both state and family arrears, the order of distribution dictates which claim to the support is paid first. When assigned support is not paid on time and becomes overdue during the assistance period, the accrued arrears are owed to the state and treated as state debt. When arrears have accrued before or after the assistance period, they are owed to families.

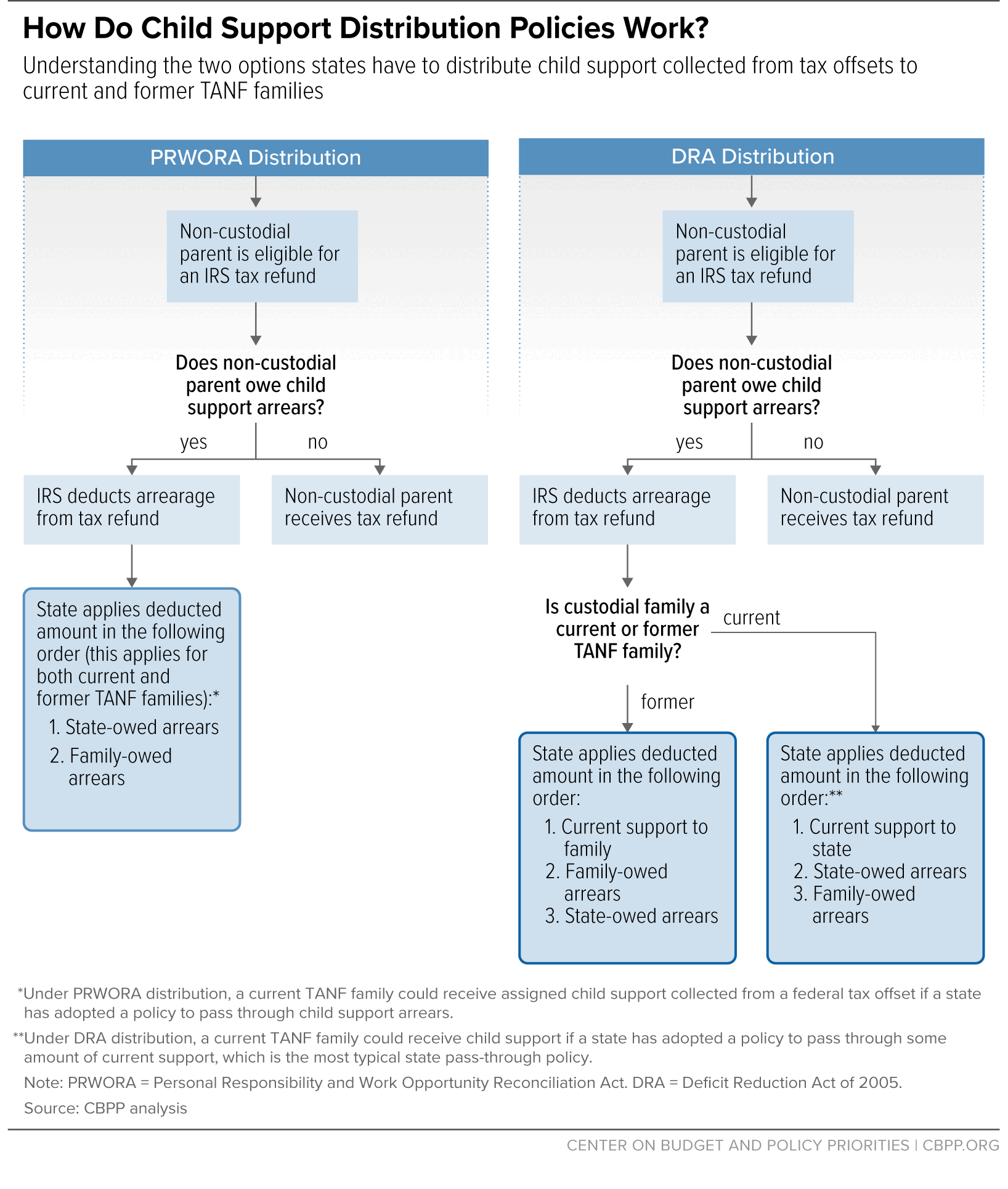

Congress has twice narrowed TANF cost recovery policies and expanded the rules that prioritize payment of child support to families, known as “family-first” distribution — through PRWORA and the DRA. Under current law, states may elect either “PRWORA distribution” or “DRA distribution” in their IV-D state plans.[49] (See Figure 1.) DRA distribution maximizes family-first allocation of payments and provides states with more options to pay child support to families.

PRWORA established two general rules for distributing child support payments: 1) collected support is allocated to pay current monthly support before arrears, regardless of the family’s TANF status; and 2) arrears that have been assigned to the state are paid first while families receive TANF, but arrears owed to the family are paid first once families stop receiving assistance.[50]These rules mean that when a family is receiving TANF, the state may keep assigned monthly support and arrears payments until the state is paid off. After a family leaves TANF, however, the rule is flipped. The family receives monthly child support payments and any arrears owed to them before the state debt is paid.

Under the general distribution rules adopted in PRWORA, the payment order in child support cases for families who formerly received TANF is sometimes referred to as family-first distribution. This is because when a family no longer receives TANF, monthly support and family arrears are paid before state debt. In other words, families are first in line for payment every time a state makes a collection when the family is no longer receiving TANF. The state debt amount does not change, but paying it off is given less priority than payments owed to families. States do not owe the federal government a share of any support distributed to families, because it is not assigned to the state.

However, PRWORA created a special rule for support collected through a federal tax offset. The IRS collects child support arrears certified by a state by offsetting child support payments owed to them from federal tax refunds and refundable credits, including the Earned Income Tax Credit (EITC). Under this special distribution rule known as the “federal tax offset exception,” states distribute federal tax offset collections to: (1) arrears, not current support, and (2) state-assigned arrears before family arrears, even when a family no longer receives TANF.[51]

In other words, under the special rule, a payment collected through a federal tax offset is applied to arrears only, and none of the payment is distributed to current support. A payment collected through a federal tax offset is the only type of payment that is not distributed to current support (the special rule applies only to federal tax offsets and does not apply to state tax offsets). The historical reason for the tax offset exception is that Congress sought to blunt the fiscal impact on states when it adopted family-first distribution rules in 1996.

The DRA gives states the option to eliminate the special distribution rule for federal tax offsets.[52] DRA distribution means that the state applies family-first distribution to federal tax offset collections in the same way that it distributes every other type of collection: the state allocates child support collected through a federal tax offset first to current support in all cases, whether it’s for a family currently or formerly receiving TANF. So far, eight states and Puerto Rico have adopted DRA distribution while the remaining states and Washington D.C. have PRWORA distribution.[53]

When a state distributes a federal tax offset collection to a family currently receiving TANF using DRA distribution rules, the current support is distributed first. However, since current support is assigned, it is kept by the state. For families who no longer receive TANF, current support is not assigned but instead is paid to the families. In the case of support distributed to former TANF families, the state does not owe a federal share because the support is not assigned.

After distributing current support to families, the state follows the general distribution rule for paying arrears. In a case involving a family currently receiving TANF, the state distributes the remaining offset collection first to arrears assigned to the state, then to family arrears. In a former assistance case, the state applies family-first distribution to allocate the remaining collection first to family arrears, then to state debt.

Even states that elect DRA distribution keep some collections that apply to arrears assigned during the assistance period unless the state passes them through to families. Under DRA distribution, family arrears are paid first, but once family arrears are paid off, state debt is next in line for payment, regardless of the collection source. However, states that elect PRWORA distribution rules keep more collections because state-assigned arrears have payment priority whenever a state collects through a federal tax offset.

Due to the order in which collected child support is distributed, most of the child support paid on behalf of families currently receiving TANF cash assistance is retained by the state.[54] On the other hand, most of the support collected for families who previously received TANF is distributed to those families. In 2022, 91 percent of the collections made on behalf of families who no longer receive assistance were paid to the families.[55] The remaining 9 percent retained by states was primarily collected through federal tax offsets.

But because there are more than five times as many former assistance cases as there are current assistance cases (including TANF and IV-E foster care cases), almost two-thirds of total child support payments retained to reimburse assistance are collected in former assistance cases.

Passing Through Support for Families

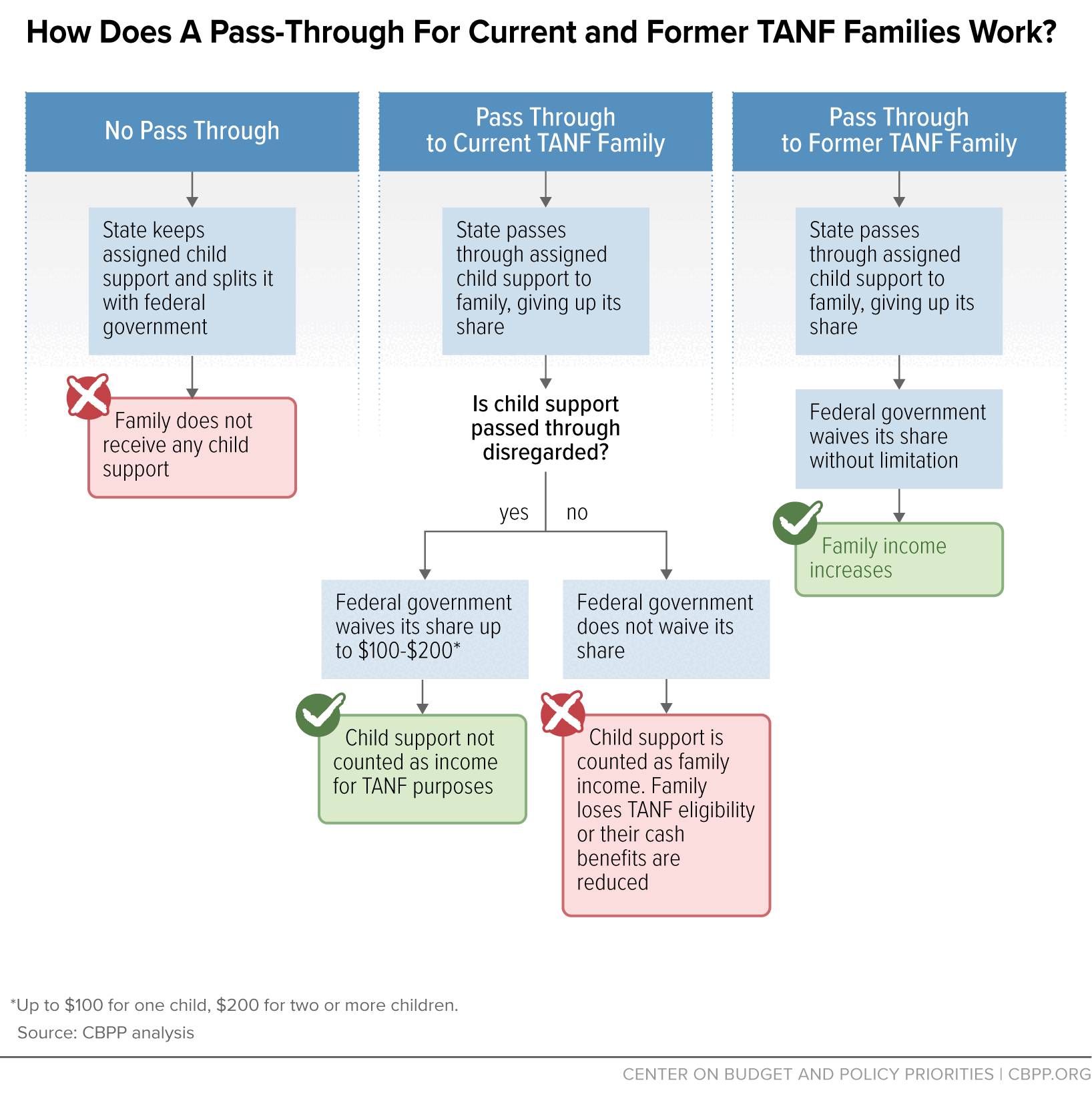

More than half of states have elected to pay families some of the child support payments that have been assigned to the state instead of keeping them as state revenues. This is called a “pass-through” policy. All child support that is “passed through” to families, whether they are currently receiving or formerly received TANF assistance, is assigned to the state. However, some states have elected to pay assigned support payments to the families rather than keep them as state revenues, i.e., the state has passed through these assigned payments to families. Implementation of a pass-through policy allows current and former TANF families to receive more support and to have a clearer sense of the financial contributions made by non-custodial parents. (See Figure 2.)

Generally, states also implement a separate policy to “disregard” any support passed through to a family receiving TANF when determining their TANF eligibility and benefit amount. Implementing a disregard policy ensures that receiving child support won’t impact families’ TANF eligibility or decrease the amount of cash benefits they receive each month. For families to benefit financially from the child support collected under an assignment, the state must both pass through the support and disregard it so cash benefits aren’t reduced dollar-for-dollar.

Under the DRA, states may pass through any amount of assigned support in current or former TANF cases. The DRA also includes a full waiver of the federal share of support passed through to families who formerly received TANF. This means the state does not owe the federal government a share of support passed through in former assistance cases. But it only includes a partial waiver of the federal share in the cases of families who currently receive TANF. By law, the federal share is waived up to $100 for one child and $200 for two or more children passed through in a month to families currently receiving TANF — but only if the amount also is disregarded in determining their TANF eligibility and benefit amounts.[56]

There is a difference between “distributing” and “passing through” support to families. Family distribution means prioritizing payment of support that is legally owed to families — paying family claims before state claims to support. Passing through support, on the other hand, means paying support to families that is assigned to the state. This happens when the state has decided as a matter of policy to redirect the assigned support to families and relinquish the revenues.

Assigned support payments, whether kept by the state or passed through by the state to families, reduce the URA balance. In other words, the reduction occurs when support is passed through to a family currently or previously receiving TANF, just as it would be if the state keeps the money.[57] States also may count the state share of support passed through and disregarded for families currently receiving assistance toward their TANF maintenance of effort (MOE) obligation, since the state is using state funds to increase cash payments to families.[58]

Before PRWORA was enacted, states were required to pass through the first $50 of monthly current support to families receiving assistance and to disregard that amount in determining their AFDC eligibility and benefit amounts. PRWORA eliminated the $50 mandatory pass through and disregard required in AFDC. Instead, the federal law gave each state the flexibility to pass through and disregard any amount of child support to families while they received cash assistance under TANF. However, PRWORA required states to pay a federal share of support regardless of their pass-through policy. The DRA enacted a limited waiver of the federal share, up to $100 for one child and $200 for two or more children.

Regardless of a state’s policy decision, however, the state was required to pay a federal share on the entire amount of collected support assigned to the state. Consequently, half of states stopped passing through support to families receiving TANF. Currently, 22 states do not pass through any amount of support. PRWORA also allowed states with AFDC fill-the-gap budgeting to maintain this form of budgeting in their TANF programs. (Fill-the-gap budgeting means that certain kinds of income do not count against a family’s TANF benefit until their income reaches a certain level. This is described more in the endnote.) Five states use fill-the-gap budgeting, which results in a significant share of child support being distributed to families receiving TANF.[59]

When a state elects the DRA option, the only way to increase child support payments to families currently receiving TANF is to pass through assigned support. That’s because for families receiving TANF, the state has the legal right to their current support and arrears under the assignment, and the payments are distributed to the state. As a result, the DRA’s family-first distribution alone does not increase child support payments to families receiving TANF; it must be paired with a pass-through policy. However, DRA ordering rules require that federal tax offset collections, like other payments, be distributed first to current support before distributing them to arrears, increasing the amount attributed to current support.

By adopting a pass-through of current support assigned to the state in combination with DRA distribution, states can pass through that portion of a tax offset collection distributed as current support, substantially increasing the amount of support available to families while receiving TANF. (Similarly, families would receive that portion of tax offset collections distributed to arrears when states pass through arrears owed to the state to families.)

Most collected child support is distributed to families who previously received TANF because they have payment priority under PRWORA family-first distribution rules. That is, they receive both current support and arrears owed to the family before any state debt is paid. However, the DRA provides states with two options for directing the remaining support to former TANF families that would otherwise be applied to state debt. First, states have the option to elect DRA distribution — that is, to apply family-first distribution to federal tax offset collections, so that the offsets are applied to current support and arrears owed to the family before state debt.

Second, states may pass through any amount of assigned support to families who currently receive or formerly received TANF. Just as states may adopt a pass-through policy for current TANF families, they also may adopt a pass-through policy for former TANF families in combination with or as an alternative to DRA family-first distribution of federal tax offset collections. Although the support is assigned and therefore belongs to the state, the state may decide as a matter of policy to redirect the assigned support to families.

By combining DRA options, states can pay all support payments to families. States can accomplish this through two alternative strategies. First, they may elect DRA distribution to prioritize family distribution of federal tax offset collections, and then pass through remaining assigned collections, so that all collections are paid to families. Alternatively, states may keep PRWORA distribution rules but still pass through any or all assigned support, including tax offset collections, to families. Both strategies can result in all collections going to current and former TANF families.

Child Support Caseloads and Collection Trends

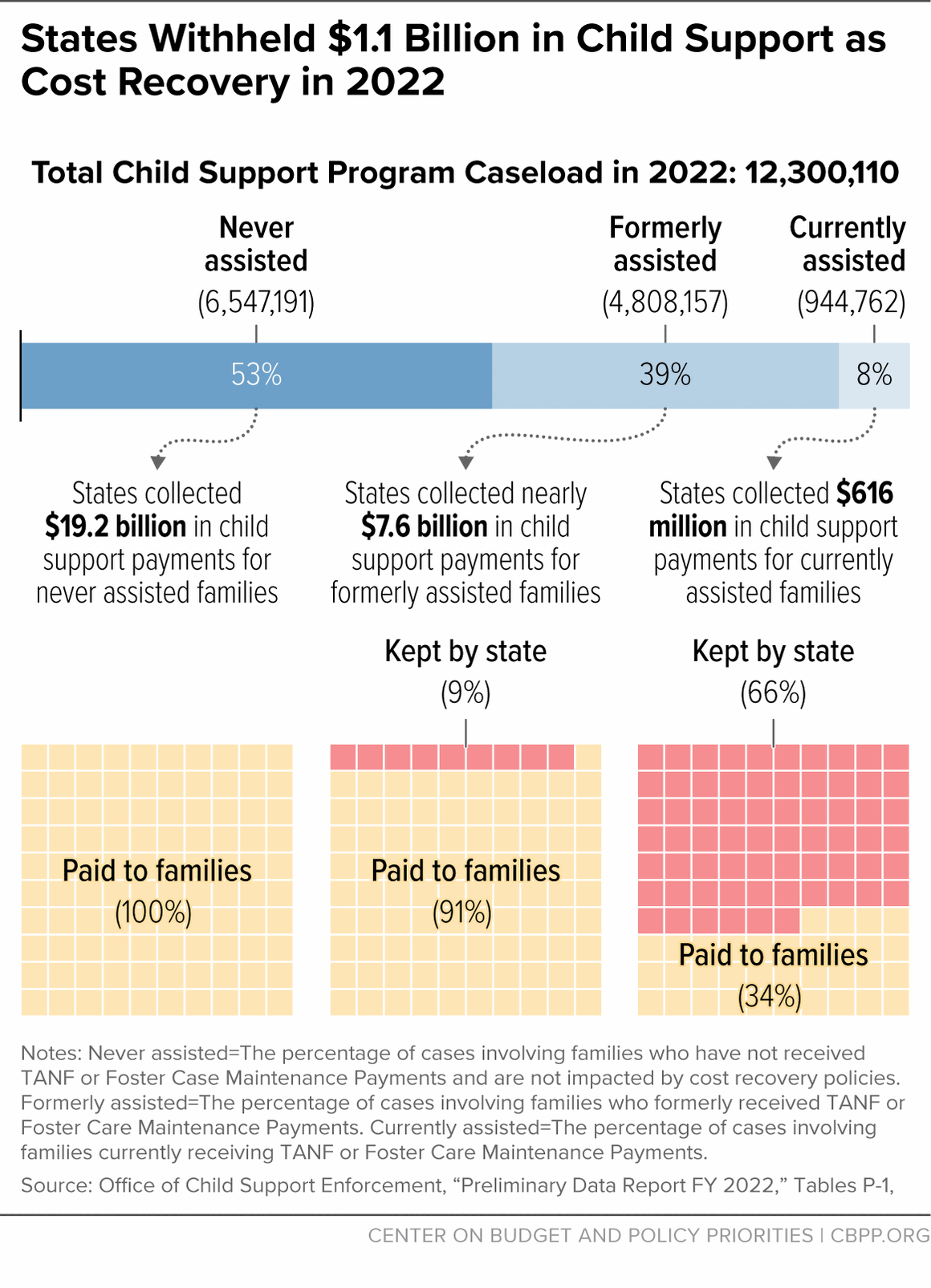

More than half of child support cases involve families who applied for child support services on their own and are not subject to the TANF assignment requirement.[60] In 2022, 53 percent of total child support cases involved families who never received cash assistance through the TANF or IV-E funded foster care programs, while 39 percent previously received assistance, and 8 percent involved families currently receiving assistance.[61]

The child support program collected more than $27 billion in 2022. Most of these dollars were collected for families who never participated in TANF. States collected $8.2 billion for families with current and former assistance cases — those potentially subject to cost recovery: $616 million in current assistance cases and nearly $7.6 billion in former assistance cases.[62] Of the $8.2 billion in combined collections made in current and former assistance cases, states kept $1.1 billion as assistance reimbursement. That’s 4 percent of total program collections, but 13 percent of combined collections made in current and former assistance cases. States kept two-thirds (66 percent) of the support collected in current assistance cases to reimburse cash assistance. By comparison, states kept 9 percent of the support collected in former assistance cases as assistance reimbursement.[63]

However, since there are significantly more former assistance cases than current assistance cases, most of the cost recovery dollars kept by the child support program are collected in former assistance cases. Of the total $1.1 billion kept as assistance reimbursement, $667 million (62 percent) were collected in former assistance cases, while $404 million (38 percent) were collected in current assistance cases.[64] The amount of assistance reimbursement has declined over the past two decades, primarily due to falling TANF caseloads. Expanded family distribution policies also have reduced the amount of reimbursement kept by states.

Child support payments kept to reimburse assistance are split between federal and state governments. Of the $1.1 billion, states kept $400 million (37 percent) and the federal government received $670 million (63 percent).[65] Cost recovery dollars are treated as government revenues that may be spent for any public purpose. Some states use child support funds to help pay for their TANF or child support programs, while others use the funds as general revenues. The federal share of support is sent to the federal treasury and treated as general revenues.“Instead of sending most of the child support payments to the federal government, states have options to give them to the families they are intended for.”

Although these are relatively small (and diminishing) amounts of funding for states and the federal government, the same isn’t true for families — receiving their child support payments (and having those payments disregarded from their TANF benefit calculation) would provide them with a valuable income source to afford basic necessities. While states spend a total of $19 billion on their TANF programs, only about $7 billion or 23 percent of total TANF spending goes to cash assistance paid directly to families.[66] An additional $1 billion would be a significant amount of money in families’ pockets. Instead of sending most of the child support payments to the federal government, states have options to give them to the families they are intended for.

Appendix Table I

Sources: Office of Child Support Enforcement, “Glossary of Common Child Support Terms,” 2013; “Instructions for the Assignment and Distribution of Child Support Under Sections 408(a)(3) and 457 of the Social Security Act, OCSE-AT-07-05, July 11, 2007; “Instructions for the Distribution of Child Support Under Section 457 of the Social Security Act, OCSE-AT-97-17, November 26, 1997.